WHAT GIFTING DOES FOR YOU:

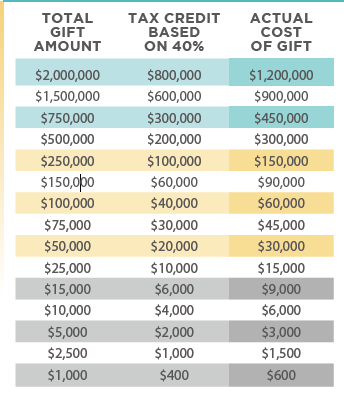

Canada Revenue Agency provides tax credits against your donation which can considerably reduce the final ‘cost’ of your charitable gift. The chart provides examples based on a 40% Ontario tax credit, however when considering any kind of gift, it is important to seek professional financial counsel.

There are many other ways to give, such as gifts of stocks or securities that may provide increased tax benefits. All gifts may be pledged over a 3 year period.